The era of cheap money is over. Rock-bottom interest rates in the U.S. and Europe since the global financial crisis made it easier to access debt than ever before, fuelling excessive borrowing from consumers and businesses.

Things have changed over the last few months, with central banks steadily increasing rates, the flow through of which touching all corners of the economy. In the hospitality investment space, this has increased deal costs, prompting concerns of a slowdown in the market. The ripple effects also touch the big brands that rely almost exclusively on third parties to develop and own the properties themselves.

Companies are seeing different impacts depending on the markets they operate in.

“On the financing side, we are not seeing any impact at this point in time. Our deals are mostly financed on the local or regional level with banks that our developers and owners have really strong deep relationships with,” said Wyndham Hotels and Resorts CFO Michele Allen on the company's Q3 earnings call last week.

Wall Street is keen to understand what’s going on given that net unit growth is a key stock pricing metric.

At Hilton, it is a similar story, although CEO Chris Nassetta sounded a little more cautious.

“While input costs are higher, the reality is those things are starting to stabilize a little bit. And you've seen other forms of construction drop off, which have provided more availability of subcontractors. And while the big banks are still … challenging from a lending point of view, our ownership community broadly is getting financed in local and regional banks, and they've still with the strongest relationships, been willing to finance,” he said.

Nassetta was speaking specifically about the U.S. market, where is still a large pool of smaller, regional banks willing to fund hotel development. The same is not necessarily true in other jurisdictions, which means companies have to find other ways to increase their portfolios.

Conversion convenience

Conversions have become the tool of choice over the past couple of years. COVID-19 lockdowns forced developers to pause their builds and the ensuing supply chain carnage meant increased costs and difficulties on getting hold of some materials. The current economic challenges mean the increased usage of conversions is here to stay.

“I think you will see continued good conversions. Because of the environment in which we are entering, getting financing is not easy and converting property is one way to resolve potentially for an asset owner, some of the financial issues that they may face. And so I think you are not going to see the rate of conversion slowdown in the future and it helps us develop better,” said Accor CFO Jean-Jacques Morin on the firm’s Q3 earnings call.

Earlier this year, Accor clinched a deal to add more than 2,000 rooms to its portfolio in Australia. Although Morin confirmed that Accor wasn’t in any current negotiations for large portfolio conversions at the moment, it is likely an area all hotel companies are looking at.

The new normal

Aside from targeting conversions, hotel brands are going to have to hope that investors start accepting that things have changed and recognise the increased costs.

“Now, they [hotel owners] are putting more equity up, they're providing, in many cases, full recourse and rates are higher. But I think their view is rates are higher for a period of time. These are short-term financings that ultimately, when assets stabilize, will be in a different environment and longer they can convert to longer-term financing that's more reasonable,” Nassetta said.

Nassetta and company will be hoping that the short-term is indeed short and that owners, wherever they are based, are able to refinance on more attractive terms.

Speaking on stage at the recent Resort and Residential Hospitality Forum, Gaël Le Lay, deputy CEO of Hova Hospitality, made a similar point to Nassetta.

“It’s maybe better not to raise debt on deals if we can, and we prefer to do them on a pure equity basis and plan to refinance later on when markets will be more stabilised,” he said.

Still a good investment?

There are a couple of reasons why the hotel brands are still optimistic despite the ongoing economic turmoil. The first is that travel demand has yet to fall off and forward bookings are still strong. The second is that, well, they have to be. Since the big brands went asset light, their growth is largely down to third-party investment. If this dries up and net unit growth slows, then their stock price heads south.

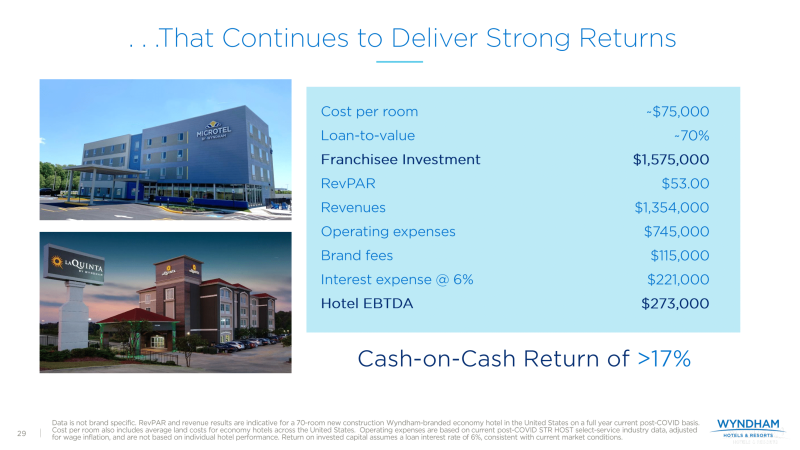

Hotel companies therefore need to stress what an attractive investment a hotel is. In its recent earnings presentation, Wyndham showed a potential cash-on-cash return of more than 17% for a particular franchisee investment, even with an interest charge of 6%.

“[This] is not the first time that we've seen volatility in interest rates. And prior instances, we haven't really seen a meaningful impact to our net room growth,” Wyndham’s Allen said.